3 min read

Longer Stays, Higher Profits: The Secret Strength of STR Channels

Jetstream

Jul 2, 2025 4:23:44 PM

Most hotels still view vacation rental platforms like Airbnb and Vrbo as "nice to have" add-ons. This is a costly misconception.

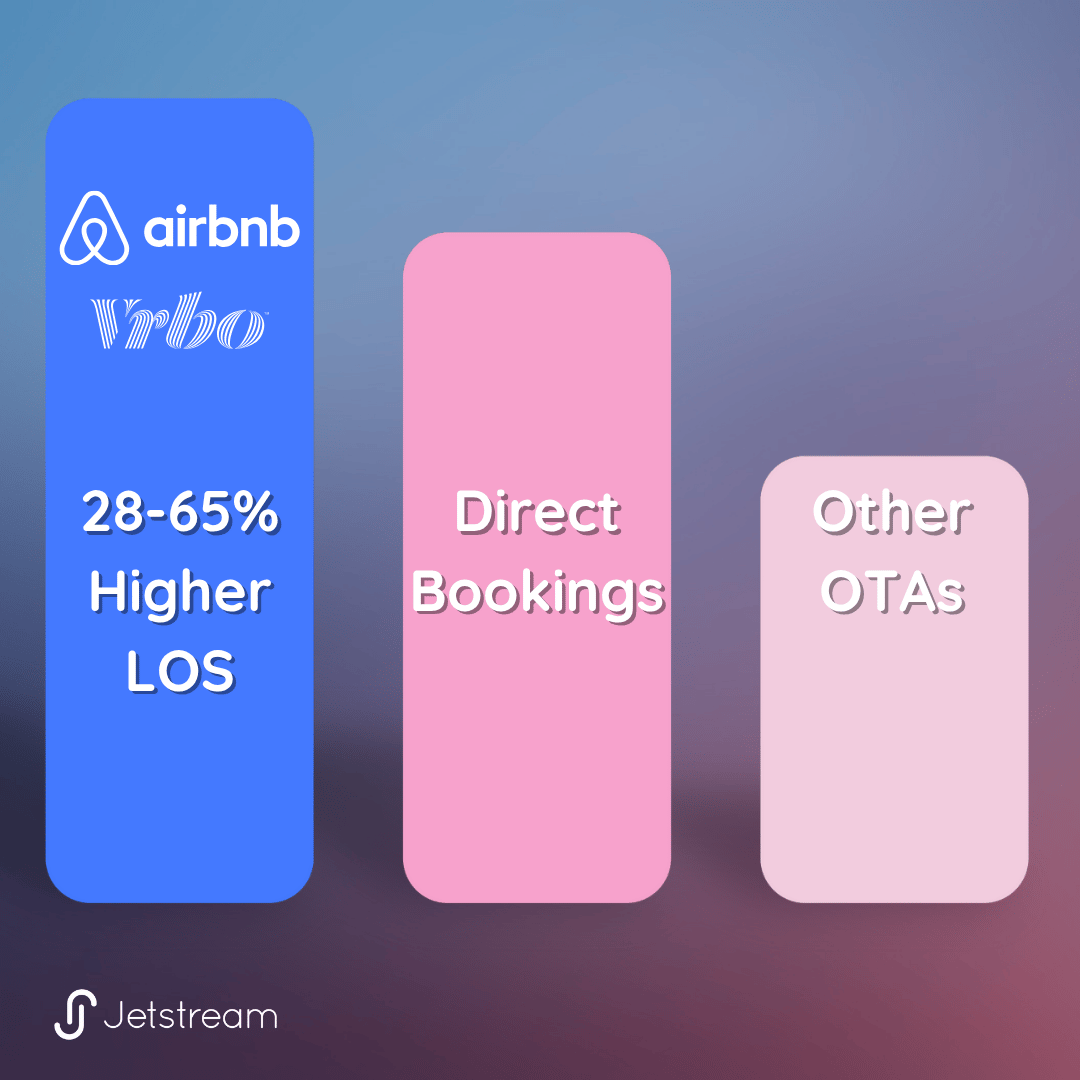

Our data shows these platforms consistently deliver stays that are 28-65% longer than traditional Hotel OTAs.

Our largest customer, a medium-sized hotel group in the Canadian Rockies, sees an average LOS of 2.9 nights compared to just 2.2 nights on their direct and traditional OTAs. That's a 28% increase.

Snow King Resort, part of Pyramid/Benchmark, reports similar results: 3.2 nights on STR platforms versus 2.5 for direct bookings, a 28% increase.

Another historic partner, Oceana Resorts (they used to be part of Wyndham before their acquisition by Vacasa) saw a remarkable 65% increase in length of stay compared to Booking.com and Expedia. You can read our previous blog post on this subject HERE.

Want to see what longer stays could look like for your hotel?

and we’ll break down how STR platforms can drive higher-value bookings for properties like yours.

Why STR Platforms Deliver Longer Stays

The answer lies in traveler intent. STR platform users aren't just passing through—they're planning extended experiences.

For leisure travelers, they're booking vacation homes with kitchens and home-like amenities for longer holiday stays.

For business travelers, they're seeking workcation spaces with kitchens where they can cook their own meals rather than endure consecutive restaurant meals during short trips.

These guests are fundamentally different from your typical OTA bookers.

Non-Cannibalizing Revenue

The most powerful aspect? These bookings represent completely new revenue streams.

STR platforms enjoy remarkable brand loyalty. Their users often search exclusively within these ecosystems rather than comparing across traditional hotel sites.

The structural difference in listings also plays a role. Traditional OTAs present properties in a hotel-resort hierarchy with room types, creating highly competitive visibility.

STR platforms display listings individually, making direct property comparisons more difficult. This creates a discovery environment where guests book based on the unique attributes of each listing rather than direct property comparisons.

The result? A new stream of travelers highly loyal to Airbnb and Vrbo who now book both leisure and increasingly business travel on these platforms.

Beyond Length of Stay: Additional Benefits

The advantages extend further:

Higher booking values. Longer stays naturally translate to higher total booking values.

Extended booking windows. STR travelers plan further ahead than traditional OTA guests, a metric that has been corroborated by many of our customers.

Amenity-focused decisions. These guests seek experiential stays with maximum amenities that feel like home or offer unique holiday experiences.

Reduced operational costs. Fewer turnovers mean less cleaning, maintenance, and administrative overhead per revenue dollar.

Research shows that labor costs represent approximately 50% of a hotel's operating expenses, making turnover reduction through longer stays a significant cost-saving opportunity.

The Financial Impact

For most of our customers, STR platforms typically contribute 2-10% of total booking mix. That's pure revenue expansion.

When you factor in the operational benefits of longer stays—less maintenance, fewer turnovers, reduced cleaning costs—the profit margin on these bookings significantly outperforms traditional channels.

According to industry research, each guest turnover (check-out/check-in) incurs substantial operational costs: room servicing, linen changes, toiletry replacements, and administrative processes. Longer stays directly reduce these costs while maintaining steady revenue. (Hotel Nuggets)

The Beach House Myth

The biggest misconception among hoteliers? That these platforms are exclusively for vacation rentals, not hotels.

I recently spoke with a hotelier in Banff who didn't even know he could list his hotel rooms with kitchens on Airbnb and Vrbo.

Many still believe these platforms cater solely to individual hosts—their original focus. But today, they welcome any property that can provide exceptional guest experiences, especially those with kitchen facilities.

Even traditional hotel rooms without kitchens can succeed on these platforms, particularly in high-demand areas where demand exceeds supply. While properties with kitchens perform best, any Instagram-worthy, boutique-style property can also attract longer-staying guests.

Implementation: A Quick Win

The best part? This isn't a long-term strategy with delayed results.

Properties can typically complete the onboarding process in 3-4 weeks, whether doing it themselves or working with a partner like Jetstream.

From there, you'll start receiving bookings almost immediately—new, higher-length-of-stay reservations from non-cannibalizing guest sources.

Key Metrics to Track

To fully understand the value of STR platforms in your distribution strategy, monitor these metrics:

- Average daily rate (ADR)

- Length of stay

- Booking window

- Percentage of total booking mix from STR platforms

- Review scores and volume

Each of these metrics typically improves when you strategically engage with STR platforms.

The Strategic Opportunity

In today's competitive hospitality landscape, finding new revenue streams is increasingly challenging. Property-level costs are rising faster than revenue, with operations, maintenance, sales, and marketing expenses each increasing nearly 5% in 2024, according to the American Hotel & Lodging Association.

STR platforms offer a unique opportunity to counter these pressures. They don't just put heads in beds—they keep them there longer, generating more revenue per booking with lower operational costs.

For hotels with kitchens and home-like amenities, this isn't just another distribution channel. It's a strategic revenue lever that directly impacts your bottom line.

The data is clear: longer stays mean higher profits. And STR platforms consistently deliver the longest stays of any booking channel.

The question isn't whether you can afford to list on these platforms. It's whether you can afford not to.

Want to find out what longer stays could mean for your P&L?

We’ll show you how to start unlocking higher-value bookings within weeks.

Our top picks |

|

|

READ: How Jetstream Powers Vail Resorts’ Airbnb and VRBO Strategy |

WATCH: CEO of Jetstream Shares Growth Tips for Airbnb & VRBO |