4 min read

Is Your Hotel’s Compset on Airbnb & VRBO? How to Find Out - and Why It Matters

Jetstream

Jun 19, 2025 5:45:28 PM

Your hotel has kitchens or suites, but you're not on vacation rental platforms. Meanwhile, your competitors might be quietly capturing an entirely different market segment right under your nose.

Most hotel groups don't realize they're missing out on significant booking opportunities by ignoring Airbnb and Vrbo. Let's change that.

In this practical guide, I'll walk you through exactly how to research if your competitors are already on these platforms and what to do with that information.

Who Should Be Asking This Question?

Hotels with kitchens or kitchenettes are ideal candidates for Airbnb and VRBO. This includes:

- Hotel groups with extended-stay or suite-style brands

- Standalone properties with kitchen-equipped rooms

- Resorts offering units with more space or condo-style layouts

These units align perfectly with what vacation rental shoppers seek—space, functionality, and flexibility.

Why Hotels Hesitate (And Why That’s a Problem)

Two main factors are holding many hotels back:

1. Awareness Gap

Some hotel operators still assume Airbnb and VRBO are only for individual homeowners. That’s no longer the case. Hotels, branded resorts, and even multi-unit properties are already succeeding on these platforms. Just weeks ago, I spoke with a potential customer who thought Airbnb and Vrbo were exclusively for individual hosts. He had no idea his hotel could be listed there and generating millions a year in new, non-cannibalizing bookings.

2. Tech Friction

Hotel tech stacks weren’t built for vacation rental logic. Rate structures, cancellation policies, and content formatting often clash with platform limitations. Many revenue managers simply don’t have the time or tools to navigate the integration challenges.

How to Check if Your Compset Is Already There

Ready to do some competitive research? Here's exactly how to check if your competition is already capturing this market:

Step 1: Prepare Your Comp Set

Have a list of your competitive set ready with their addresses and locations on a printed google map. Your revenue manager should already have this defined

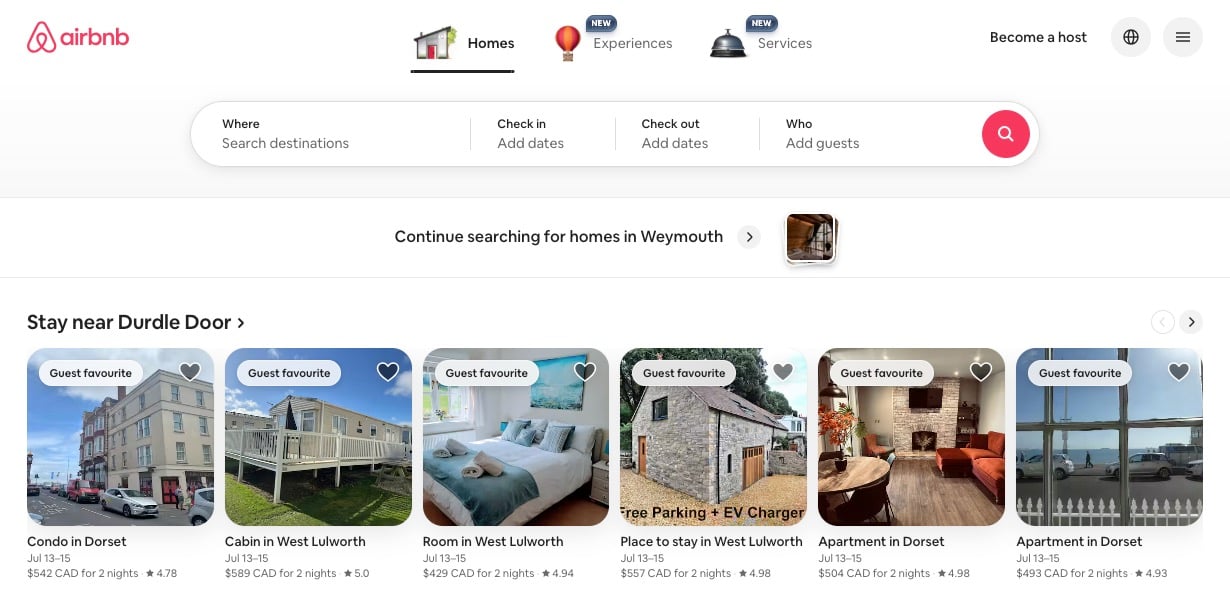

Step 2: Basic Search

Go to airbnb.com and enter your destination in the search bar. Don't enter any dates yet.

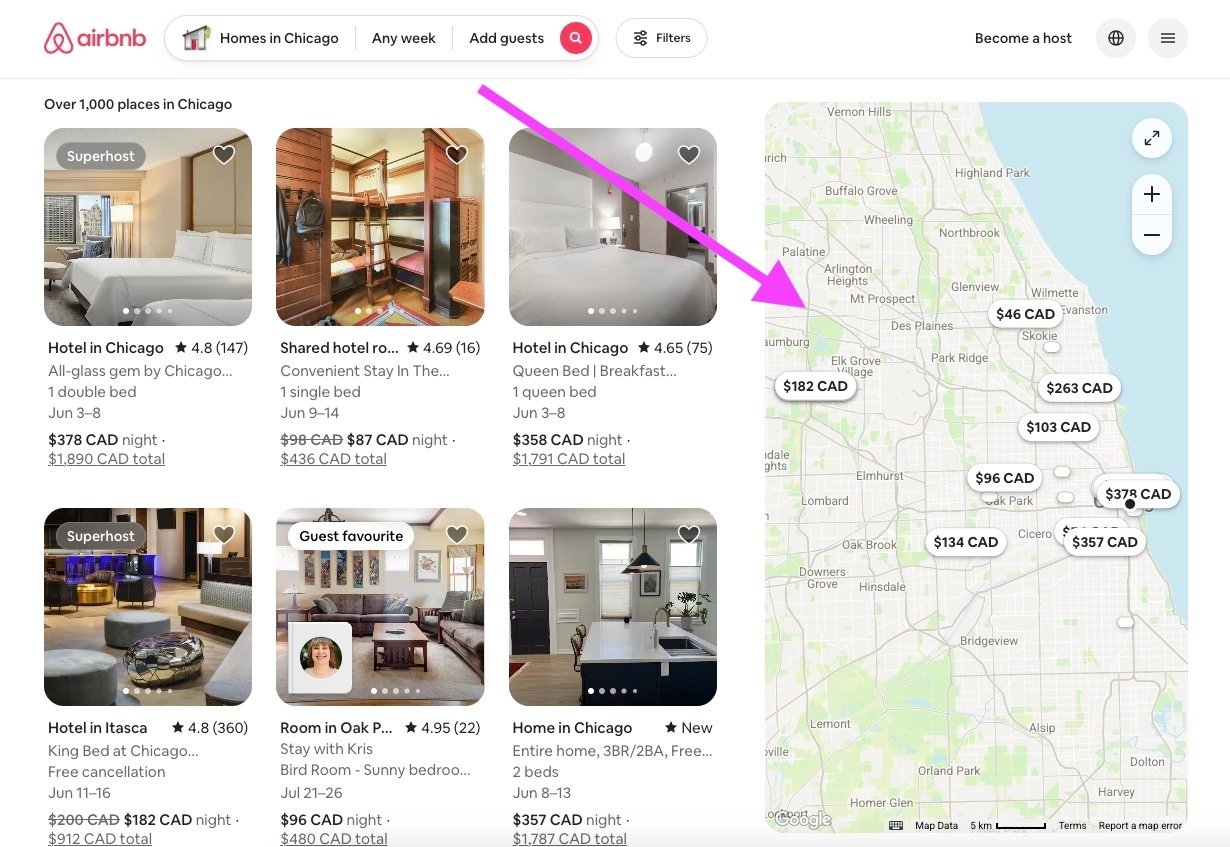

Step 3: Use the Map View

Zoom in deeply on the map to the exact location of each competitor. This is crucial because Airbnb's display algorithm doesn't always show all listings in the general search.

Remember that unlike Booking.com or Expedia, each room type will be its own individual listing on Airbnb with no connection to an “overall Hotel or Resort property”.

If you see zero listings even at high zoom levels, that competitor isn't on Airbnb.

Step 4: Confirm the Host

Some branded properties list under opaque hosts or third parties. Click into host profiles to see if multiple rooms or unit types are listed. You may also find other competitor listings under the host account.

Option 1: Filter by Room Count

If your hotel has suites with multiple bedrooms, use the filters to search specifically for 4-5 bedroom properties. This drastically reduces the number of listings displayed, making it easier to spot competitors.

Option 2: Search by Unique Amenities

Does your property have something unique like a pool, hot tub, bbq or other special amenity? Search by that feature to narrow down listings that might be from competitors.

What To Do With Your Research Findings

Scenario 1: You’re First

Many hotels with great inventory aren't on these platforms yet. If your comp set is missing, you have a first-mover advantage.

What to do:

- Get your listings up quickly!

- Focus on quality and guest experience to generate excellent reviews

- Start the performance flywheel before competitors even know what's happening

Scenario 2: You’re Late

If competitors are already there, you need to move fast to avoid losing market share.

What to do:

- Study competitor reviews carefully to understand what vacation rental guests value

- Note where competitors are failing so you can avoid the same mistakes

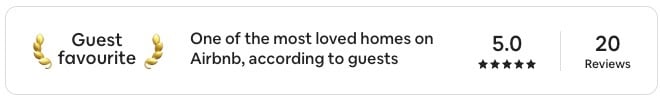

- See if they have Superhost or Guest Favorite tags. These drive outsized visibility.

- Focus on delivering exceptional experiences to earn higher review scores

Key Metrics to Analyze in Competitor Listings

Beyond just checking if competitors are present, look for these critical performance indicators:

Review Scores

This is the single most important metric. Unlike traditional OTAs, you can't pay for higher placement on Airbnb and Vrbo.

Placement is purely a meritocracy based on conversion, which is heavily influenced by reviews, photos, pricing, and listing quality.

Superhost Status

Check if competitors have earned Superhost status, which requires maintaining a 4.8+ review score. This badge significantly boosts visibility.

Guest Favorite Tags

The most valuable indicator is whether listings are tagged as "Guest Favorite".

In Jetstream's experience, Guest Favorite listings receive three times (3x!) the search impressions and booking volume compared to regular listings.

According to recent data, the Guest Favorites badge now carries even more weight than Superhost status in driving visibility on Airbnb (source).

Common Technical Challenges (And How to Overcome Them)

1. Content Merchandising

Most hotel PMS and channel managers don't support the rich content feeds required by Airbnb and Vrbo. Hotels can create listings manually within these platforms, but connecting existing systems is challenging without specialized middleware. And on Airbnb and Vrbo, content is king.

2. Rate Plan Limitations

Vacation rental platforms only support one rate plan per listing. Hotels with multiple discounts, LOS pricing, or seasonal cancellation rules must simplify—or use a system that can automate that complexity.

The Fastest Way to Get Listed

If you discover competitors are already capturing this market, you need to move quickly.

The fastest approach is to work with a specialized partner like Jetstream who can have you live with polished content and proper rate code mapping in under three weeks.

For those going the DIY route, be prepared for a significant learning curve and manual processes.

Pricing Strategy for New Listings

Both Airbnb and Vrbo highly recommend discounting your first three bookings by 20%. Since you can't pay for higher placement, it's crucial to generate early booking momentum in the first 30-45 days.

Both platforms offer promotional tools that automatically apply this discount for new listings and remove it after the third booking. After establishing your presence, focus on long-term pricing strategies that incentivize extended stays.

Common Misconceptions That Hold Hotels Back

-

“These platforms are only for beach homes and cabins”

Not true—condo-hotels, suites, and urban inventory thrive here.

-

“Hotel listings won’t perform”

They will—if merchandised correctly and priced smartly.

Hotels have one advantage most STR operators don’t: multi-unit inventory. This makes it easier to generate reviews and build booking volume fast over traditional single-unit-per-listing inventory.

Take Action Today

Whether your compset is active or not, the opportunity is clear.

Run the research. Understand your position. Then decide:

• Are you ahead and ready to lead?

• Or behind, and ready to catch up?

Either way, Airbnb and VRBO represent untapped demand. Your guests are already there. It’s time your listings were too. Check out our How-To List on Airbnb & VRBO Guide. Or book a meeting with our Team to learn how we can help.

Our top picks |

|

|

READ: How Jetstream Powers Vail Resorts’ Airbnb and VRBO Strategy |

WATCH: CEO of Jetstream Shares Growth Tips for Airbnb & VRBO |

Related Posts